Here are some updates for participating employers regarding the NHRS employer Data Reporting System (DRS):

Salary variance exceeded exception to be activated

This exception had been disabled for the past six months but will be turned on May 31.

We have posted instructions on how to clear this exception on the Employer Resources page.

See: https://www.nhrs.org/employers/employer-resources

Non-Reporter exception instructions

The Non-Reporter exception occurs if a member is included in the monthly reporting batch but has no reported wages. The most common reason for this exception is that the member is no longer working for the employer, but the employer has not added a termination date and termination reason to the member’s record.

See: https://www.nhrs.org/employers/employer-resources

FY 2025 batches and vouchers

NHRS has posted the employer reporting schedules and associated payroll vouchers for fiscal year (FY) 2025, which begins July 1, 2024. This information is available in the DRS. Please be aware that batch and voucher numbers no longer go in chronological order.

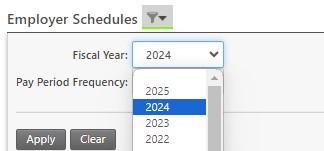

Note: Because the new schedules have been created, the DRS automatically defaults to FY 2025. To access the FY 2024 schedules needed for May and June reporting, click on the funnel icon to choose a different fiscal year from the drop-down menu.

Listening sessions

Thanks to all employers who took part in one of our DRS employer listening sessions in April and May. Your feedback will be a tremendous help as we move forward with system enhancements and additional instructions.

Reminders

Employer penalties

As part of the transition to the new DRS, the automated penalties for late posting of monthly wage and contribution data have been turned off since late 2023. NHRS plans to re-institute late reporting and payment penalties beginning with the reporting of May member data due in June. Penalties may be assessed to employers who willfully, intentionally, through gross negligence, or through a pattern of negligence fail to file the data as required. For more information on penalties, see:

https://www.nhrs.org/employers/employer-resources/reporting-and-payment-penalties

Resources

Written instructions for using the DRS are available on our website. We will continue to add and update instructions over the coming months. See: https://www.nhrs.org/employers/employer-resources