Trust Fund

The net assets of the retirement system were valued at $12.3 billion as of June 30, 2024.

Funding for NHRS pension benefits is derived from member contributions, employer contributions and trust fund assets. Investment returns have historically provided the bulk of funding for pension benefits.

Article 36-a of the New Hampshire Constitution prescribes that retirement system funds are to be used for the “exclusive purpose of providing for such (retirement and related benefits) and shall not be encumbered for, or diverted to, any other purposes.”

10-year History of Net Position Held in Trust for Benefits (in millions)

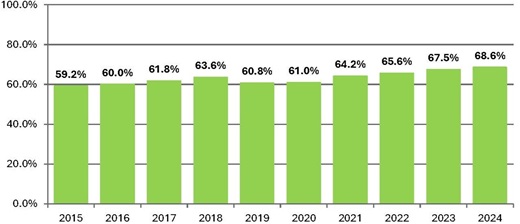

NHRS was 68.6 percent funded at the close of the 2024 fiscal year. This means that the actuarial value of the retirement system’s assets is 68.6 percent of the projected amount needed to pay for current and accrued benefits for retirees and active members. Additional background on NHRS funding and liabilities is available in the “NHRS … Now You Know” section.

10-year History of Funded Ratio

Note: Funded ratio impacted by changes to actuarial assumptions in 2016, and 2020.

NHRS paid out $1 billion in pension benefits to 45,330 retirees or their beneficiaries in fiscal year 2024. In addition to pension benefits, NHRS paid out $39.5 million in post-retirement Medical Subsidy allowances.

Financial Accounting Data

The NHRS Annual Comprehensive Financial Report (ACFR) includes financial accounting data required under Governmental Accounting Standards Board (GASB) statements No. 67, which deals with financial reporting for pension plans, and No. 74, which deals with financial reporting of OPEB benefits (i.e. the Medical Subsidy).

This information is for accounting purposes only and does not impact employer contribution rates or the statutory funding plan in place to pay down the NHRS unfunded liability.

For additional information on GASB reporting, see: https://www.nhrs.org/employers/gasb