Here are some recent updates for participating employers regarding the NHRS employer Data Reporting System (DRS):

Updated instructions: In response to questions concerning the Salary Variance Exceeded exception, we have expanded the instructions on how to clear this exception to include a glossary of when to use the reasons listed in the drop-down menu and what happens next when a specific reasons is selected.

More personalized service: NHRS has implemented a new employer relationship structure, assigning employers to a specific NHRS relationship manager. The goal is to improve the experience, from reporting through payment, by having one primary point of contact. Your representative is listed in the Associations section of your DRS dashboard.

Help for new users: We updated our FAQ for new DRS users. These frequently asked questions (FAQ) are intended to provide some basic information for new users who have never reported before.

Previous updates

Automated batch posting is back: The Employer Reporting Batch Scan Process to directly post exception-free monthly reporting will be turned on effective June 1. This process will run every five minutes to pick up trials and to post employer files that have cleared all exceptions. Employers will no longer need to notify NHRS and ask us to post their files for them! Instructions for submitting a batch for posting are available here.

Pay period adjustment exception instructions: An exception is generated when an employer issues additional checks to a member – such as termination pay, balloon payments for teachers, or any other stipends/payouts – within the same pay period dates. These instructions show how to clear this exception, as well as how to change the pay type for the additional payment in your XML file to avoid getting the exception at all. The instructions are available here.

Reminders

FY 25 batches and vouchers: NHRS has posted the employer reporting schedules and associated payroll vouchers for fiscal year (FY) 2025, which begins July 1, 2024. This information is available in the DRS. Please be aware that batch and voucher numbers no longer go in chronological order.

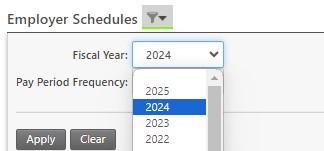

Note: Because the new schedules have been created, the DRS automatically defaults to FY 2025. To access the FY 2024 schedules needed for May and June reporting, click on the funnel icon to choose a different fiscal year from the drop-down menu.

Salary variance exceeded exception: This exception, which had been disabled for the past six months, has been turned back on.

Employer penalties: As part of the transition to the new DRS, the automated penalties for late posting of monthly wage and contribution data have been turned off since late 2023. NHRS plans to reinstitute late reporting and payment penalties beginning with the reporting of May member data due in June. Penalties may be assessed to employers who willfully, intentionally, through gross negligence, or through a pattern of negligence fail to file the data as required. For more information on penalties, click here.