How to Read Your Form 1099-R

What is Form 1099-R?

Form 1099-R reports distributions from pensions, annuities, retirement plans, IRAs, insurance contracts, and other similar sources. If you received $10 or more from these sources during the tax year, you should receive this form from the payer by January 31st.

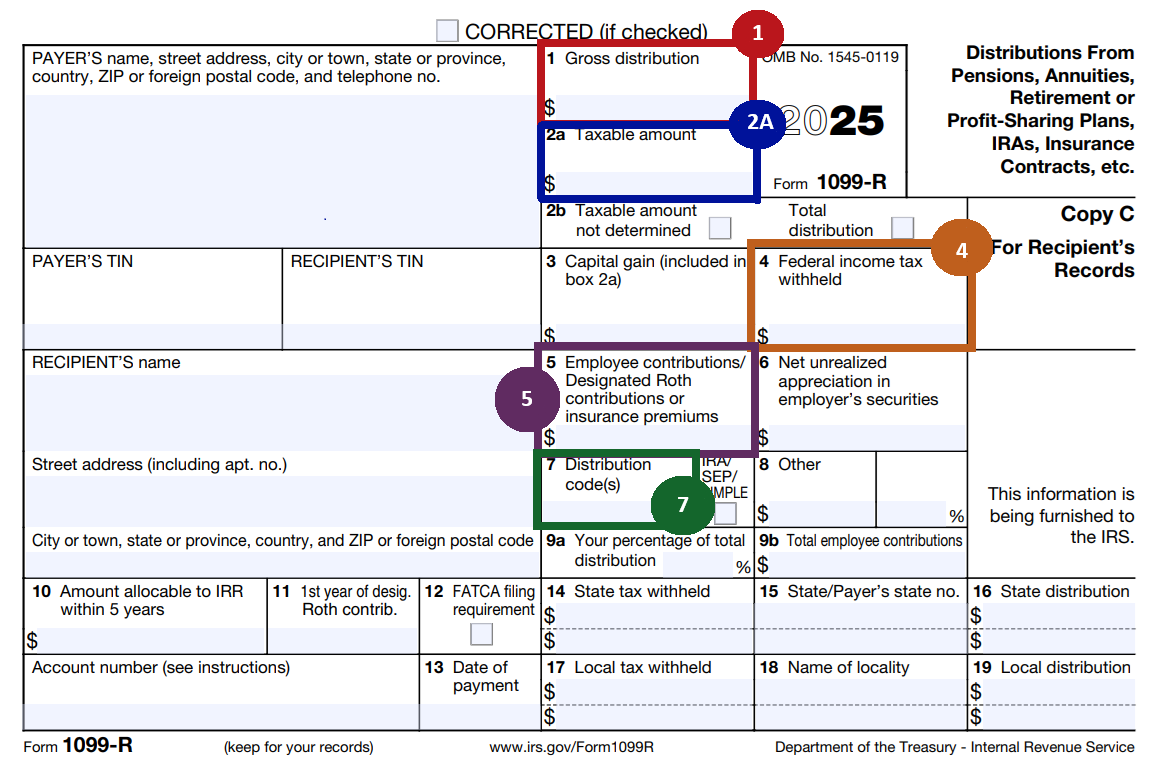

Form 1099-R Sample

Figure: Example 2025 Form 1099-R with key boxes highlighted (numbered circles). See the colored legend below for box identification.

Key Boxes Highlighted:

1

Box 1

2a

Box 2a

4

Box 4

5

Box 5

7

Box 7

Key Boxes to Understand

| Box |

Label |

What it Means |

| 1 |

Gross Distribution |

Total amount of your pension or retirement distribution before any taxes or deductions. |

| 2a |

Taxable Amount |

The portion you must report as income on your federal tax return. This is typically less than Box 1 because it excludes amounts you already paid taxes on. |

| 4 |

Federal Income Tax Withheld |

Amount of federal tax already withheld from your distribution and sent to the IRS on your behalf. You can claim this as a credit on your tax return. |

| 5 |

Employee Contributions / Designated Roth Contributions |

The portion of your distribution that represents your after-tax contributions. You already paid taxes on this money, so you won't be taxed again. Also known as your "cost basis." |

| 7 |

Distribution Code(s) |

IRS code identifying the type of distribution you received. Common codes: 1 (early distribution with potential penalty), 2 (early distribution, exception applies), 4 (death distribution), 7 (normal distribution), G (direct rollover). |

Additional Resources

Need Help? Consult with a qualified tax professional regarding your specific tax situation.